Following the UK’s Autumn Budget announcement on 30th October 2024, the drinks and hospitality industry are preparing for the upcoming changes to alcohol duty – which will take effect on 1st February 2025.

Duty changes in line with ABV

From 1st August 2023, new legislation for duty on alcohol products came into place. While some products were previously measured on volume only – such as still wine and cider – from 1st August all alcohol products were to be measured by alcohol volume or ABV. In simple terms, the higher the alcohol by volume (ABV), the higher the new duty rate will be.

The Government acknowledged the additional bureaucracy for wine businesses and introduced an 18-month “easement” period, during which wine between 11.5-14.5% ABV would be taxed at a single amount aligned to the rate payable on wine at 12.5% ABV. But this easement ends on the 1st of February 2025.

In addition, duty rates on non-draught alcohol products will also rise in line with the Retail Price Index (RPI) from February 2025.

What does this mean for beer?

In the budget, the Chancellor announced a 1.7% reduction in alcohol duty on draught products, which applies to beers, ciders and other drinks on tap.

This will increase the value of Draught Relief from 9.2% to 13.9% for qualifying beer and cider products, and from 23% to 26.9% for qualifying wine, other fermented products and spirits.

However, the standard rate of duty on non-draught products will see an increase of 3.6%.

What does this mean for wine?

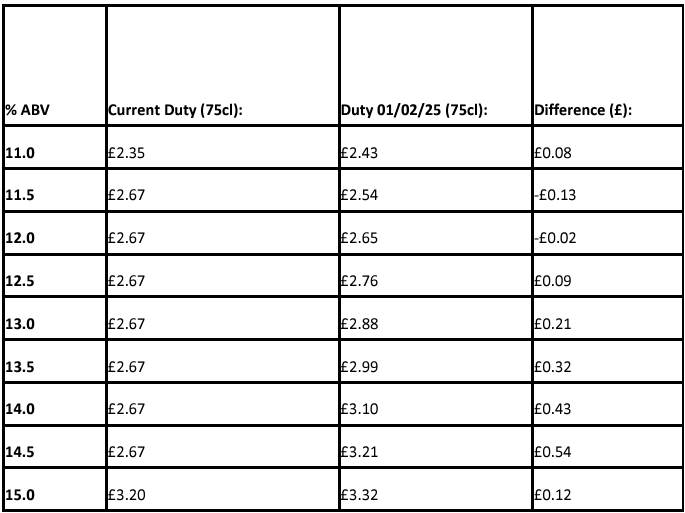

When the wine easement ends on 1st February 2025, the single amount of duty paid on wines between 11.5 and14.5% ABV – £2.67 per 75cl bottle – will be replaced with up to 30 different payable amounts according to the strength of the wine now declared at 0.1% volume increments. For a bottle of wine at 14.5% ABV, this will see wine duty increase from £2.67 a bottle to £3.21. The duty rates set on 1st August 2023 will also increase in-line with forecasted RPI inflation.

The further abolishment of separate duty rates for sparkling and still wine means that from 1st February, a bottle of Champagne or sparkling wine will have its duty reduced by £0.02, bringing it down to £2.65 and in line with a 12% ABV still wine.

What does this mean for spirits?

Non-draught spirits are also set to see an increase in duty from 1st February 2025. A 70cl bottle of 37.5% ABV spirit is set to see its duty increase by £0.30, while a 70cl bottle of 40% ABV spirit is set to see its duty increase by £0.33.

The WSTA have outlined the full scope of the duty changes across each category. For more information visit their website or check out the UK Government’s policy paper.

How does this affect your venue?

To prepare for the upcoming changes to alcohol duty, we recommend working with your supplier to curate a range, that reflects value and maximises profit, ahead of the duty increase coming into effect from 1st February. The changes mean there may be a trend towards lower ABV entry level wines to maintain competitive pricing. However, it’s important to note that trading up still gets you better quality, and small trade ups have proportionally large effects on this increase in quality.

Despite a squeeze on household budgets, hospitality venues remain a key part of consumers’ spending habits, with a growing number of consumers opting to spend money on making memories over spending on material possessions. The appetite for memorable, sociable experiences is higher than ever, with special events, live entertainment and sports as the top areas of spending in the ‘experience economy’.

While people may be drinking less, they are happy to spend a little more for a better-quality drink when they do go out. Venues can cater to these treat occasions by spotlighting their premium drinks offering, through menu nods or with staff recommendations. They can also give customers a chance to explore flavours with creative cocktails and serves.

How Matthew Clark has been preparing for the duty changes

For the past 18 months, we have been planning for this change across all impacted geographies and business units. We have invested in systems and solutions that will aid customers when the ABV on any wine changes, to mitigate against the challenges the duty system change brings.

Given the increased complexity, we began communicating the potential impact of these changes to our customers several months ago. Our sales teams are working closely with customers to ensure they are aware of the changes and what it means for their listings.

If you have any questions or concerns about the impact of the duty changes, reach out to your Matthew Clark account manager or contact us by email.

Sources: